The bet was simple: if you thought the deal would close at $190 a share, you bought all you could at $169 a share. Investors relying only on public information could have entered the position at that level. The Red Hat merger arb spread was 12% on the day after the deal was announced. IBM/Red Hat Merger Arbitrage Chart by author

But if all goes well, the spread closes as the deal approaches its conclusion. It exists because the deal will take several months (on average) to close, and there is some possibility that it may fall apart, for any number of reasons. Typically, however, the target company’s shares do not immediately reach the level of the offer, but hover somewhat below it. Salesforce’s premium for Slack is in the same range (50-55%), though because it includes both cash and stock, the value of the offer fluctuates in sync with the value of Salesforce’s own shares. Microsoft’s offered a 50% premium for Linked In. IBM bid 60% above Red Hat’s previous share price. Even though it is only a bid (and not a done deal), the market price will rise in anticipation of its consummation. The offer price entails a significant premium over the current market price.

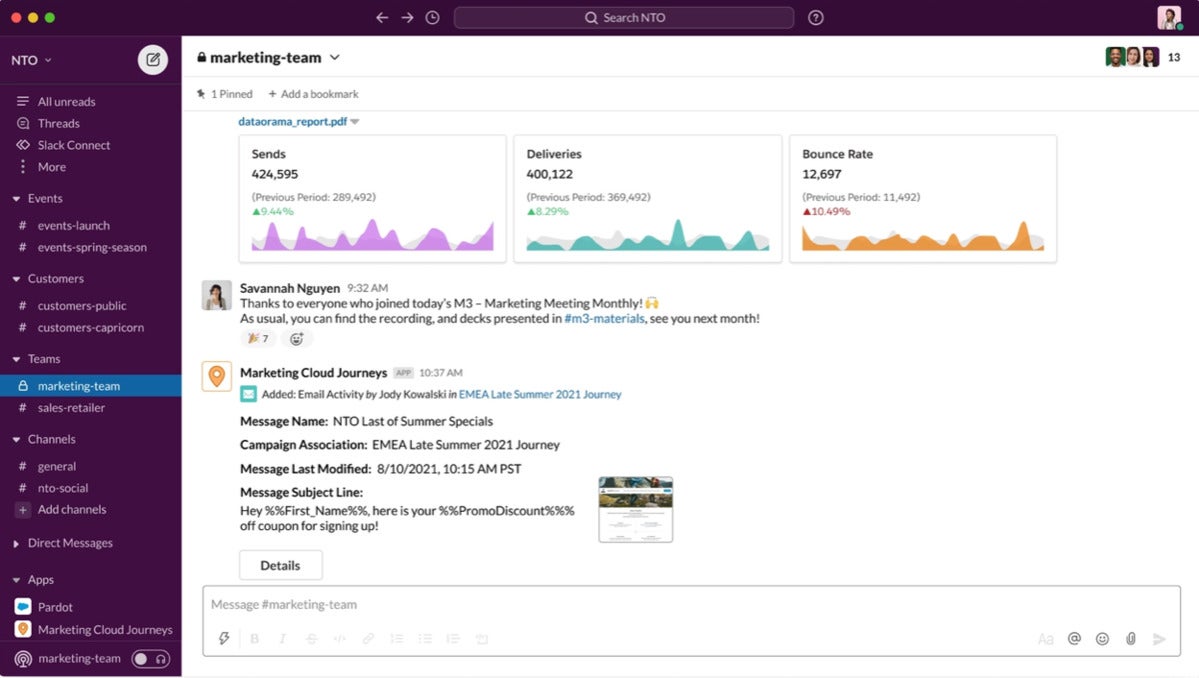

First of all, the shares of the target rise promptly to somewhere near the offering price. The objective of the strategy is to capture the arbitrage spread-the difference between the acquisition price and the price at which the target’s stock trades before the consummation of the merger.”Ī bid by one company to acquire another company always has two effects. It may also involve shorting the shares of the acquiring company. “Merger arbitrage is an investment strategy that involves buying shares of a company that is being acquired.The first thing to say about all this is that it constitutes a nice illustration of a stereotypical market pattern, triggered by an acquisition event – which sets up an investment strategy known as merger arbitrage. Salesforce & Slack Nov 25-Chart by author

0 kommentar(er)

0 kommentar(er)